Ira Limits 2025 Tax Year

Ira Limits 2025 Tax Year - The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. Roth IRA Limits for 2025 Personal Finance Club, The maximum total annual contribution for all your iras (traditional and roth) combined is: But each year, the irs adjusts the rules for ira eligibility based on inflation.

The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, Learn about tax deductions, iras and work retirement plans, spousal iras and more. If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth ira, and if.

Ira Annual Limit 2025 Mitzi Teriann, Ira contribution limit increased for 2025. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan.

However, income limits apply that determine whether you. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan.

Ira Limits 2025 Tax Year. However, income limits apply that determine whether you. The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are eligible for.

2025 Roth Ira Limits Janey Lilian, Your personal roth ira contribution limit, or eligibility to contribute at. For other retirement plans contribution.

Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your.

2025 Limits For Traditional Ira Clair Demeter, Income tax slabs, union budget 2025 live: This deadline expires when 2025 taxes are due on april 15, 2025.

After Tax Ira Contribution Limits 2025 Marty Shaylyn, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. What are the ira changes for 2025.

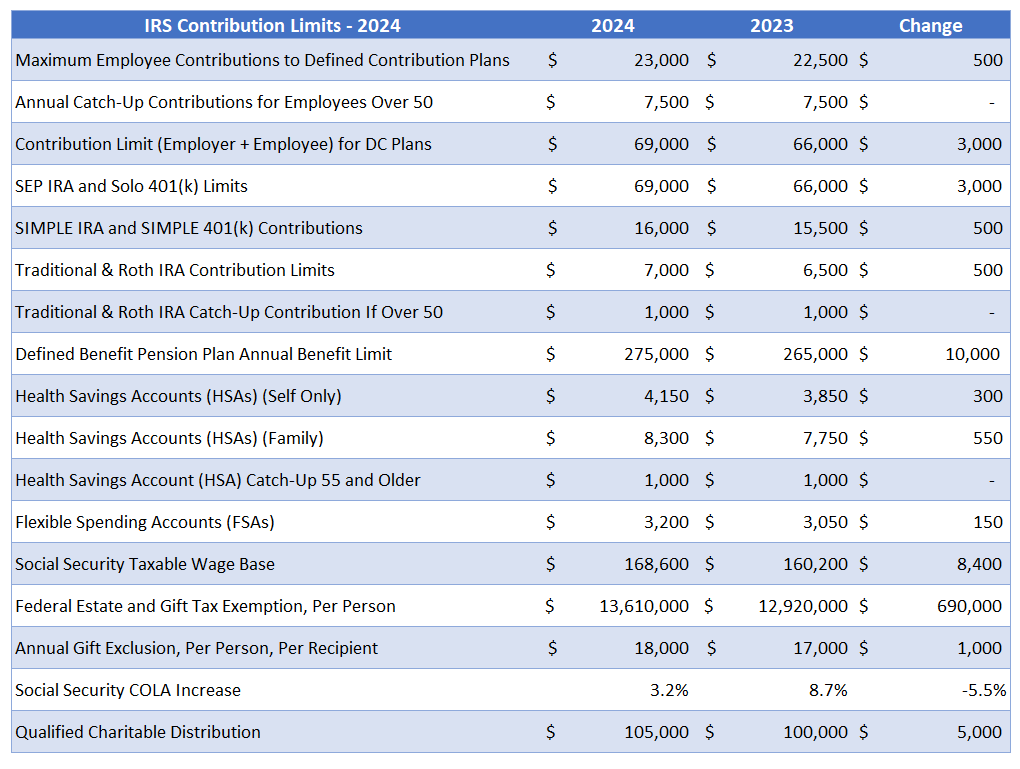

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, The government has increased the standard deduction limit to rs 75,000, allowing the salaried class to save up to rs 17,500 in. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or.

Tax Deductible Ira Limits 2025 Sandi Cordelie, Income tax slabs, union budget 2025 live: The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are eligible for. Ira contribution limit increased for 2025.

2025 Ira Contribution Limits Estimated Tax Payments Tish Adriane, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or. The maximum total annual contribution for all your iras (traditional and roth) combined is: